I realize it’s essential to manage your finances as a family when one Saturday afternoon, my husband came running into the house and called out, “Honey come and take a look at what I just got!” I got so excited and ran out of the kitchen to meet him. But as I entered the living room, my smile quickly turned into a frown when I saw what he held in his hands. He anxiously opened the box to show me the new TV he just purchased, and as he described all the features, I just got more aggravated.

“We don’t have the money to be buying such an expensive TV,” I said.

“Don’t worry babe, of course, we do. We are getting our tax refund soon, so it’s covered. Besides, I got a terrific deal and we had talked about getting a bigger TV. So when I saw the sale sign, I couldn’t pass it up.”

“But that money was supposed to go towards a down payment for a house! I can’t believe you would be this irresponsible.”

“Irresponsible? What are you talking about? I bought this TV for the both of us. We might never have enough money for the downpayment anyway, so why not enjoy it now. I just can’t understand why you are so stingy?”

As you can imagine, this turned into quite a fight, but we realized that we had to talk about how we handled our finances as a family. It was vital for us to be on the same page regarding how we used money in our home.

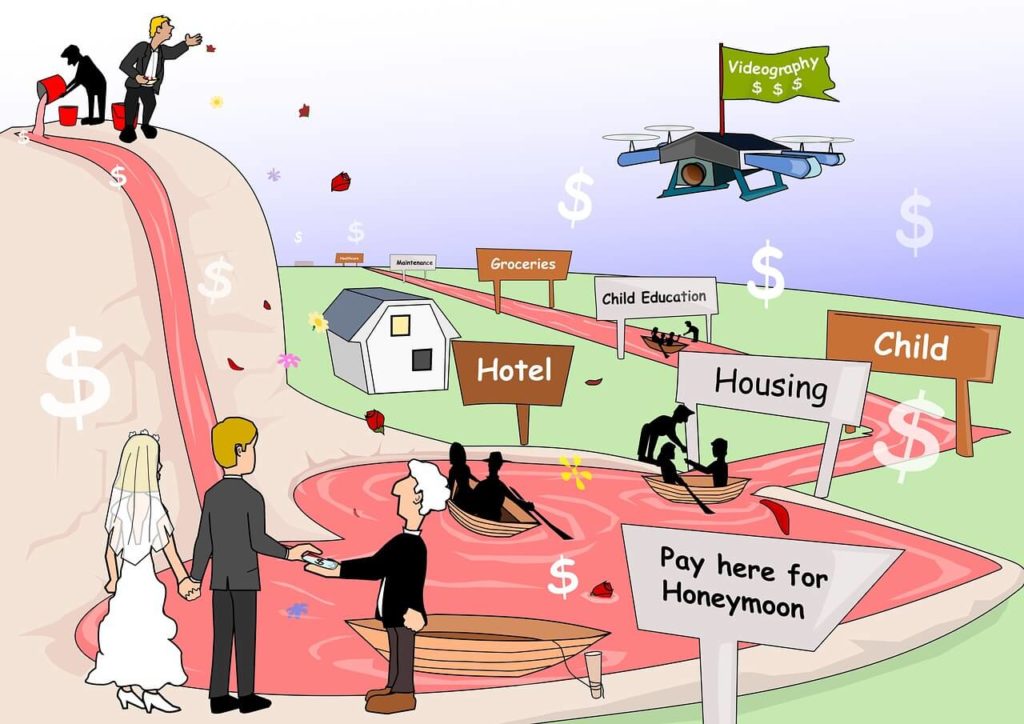

Money can be quite a touchy subject, especially in relationships. For you to have a happy, peaceful life with financial freedom, you must manage your finances a family well. It is every parent’s sacred duty to provide for their kids’ needs, and financial stability can affect a family’s emotional tranquility. Money can build or destroy your marriage. If you always fight about your finances, it can lead to mistrust, selfishness, lying, and even divorce.

After infidelity, fights over family finances are the second leading cause of divorce in America. According to recent studies, high levels of debt and lack of communication are the major causes of stress and anxiety surrounding family finances. The more debt a couple has, the more likely they are to fight about their money management. Couples who talk about money on a daily or weekly basis are more likely to have better, fulfilling relationships. When a couple eliminates debt and manages their money well, a shift happens in their marriage. They experience peace of mind that was not there before.

So we sat down and talked about how we were going to reign in our finances, pay off our debts, and be financially stable. Below are some of the tips we used and you can adapt to manage your family finances.

Table of Contents

Synchronize your family finances

The first thing we realized was how essential it was for us to understand each other’s financial differences, such as who was the spender and who was the saver. This made it easier to get on the same page as we understood each other’s money attitudes. Having a frank dialogue about money is the first step. Establishing financial honesty eliminates the chances of lying and resentment down the road. You should discuss your current financial situation with details such as how much you both earn, where the money goes, your credit histories, and if you are in debt. This will help set a tone for openness regarding finances.

Discuss your finances regularly

You can designate a specific day to meet and talk about your finances. This is vital if you want to manage your finances as a family. This meet-up can be before the bills are due every month. This gives you a chance to asses your expenditure for the previous months. You get to see how close you are to achieving your long-term goals and suggest any changes or purchases. For us buying a house was a long-term goal, so whenever we met, we would check and see how much progress we made towards this goal.

Don’t let one person handle all the finances

While it might seem like a good idea to let either you or your spouse handle the family money, it places a considerable burden on their shoulders. Also, the others end up being unaware of the family’s current financial situation. If you were to divorce or pass on, the rest of the family is left unaware of how to manage or access their money. The best thing is to split the responsibility between both of you.

Have a budget

A budget is the first step to manage your finances as a family. A family budget is a record of what you earn and how you spend it. It helps you spend money on what you need, prevent you from accidental overspending, save for what you want, and have some cash in case of emergency. You avoid unnecessary consumer debt and manage your credit score. It is vital to work out how much money you need for daily essentials like food, utilities, housing, transport, and medical care. This ensures that you have enough left over for unexpected expenses and emergencies.

Always remember to make balanced plans for your family. The reason why most people don’t follow budgets is they don’t set aside money for what they want to do. Always have a kiti for the things you want such as a holiday, a new car, random clothes etc. Balance will make it easy for you to manage your finances as a family, and enjoy life as you wish.

The golden rule of budgeting is to spend less than you earn. For instance, we used online budget planners and savings calculators to work out our monthly expenses and figure out how much we could save. After assessing our spending habits, we were able to see where we could cut back and other adjustments that could be made to save more. These savings went to our emergency, retirement, and college funds. We also planned to use some of the money to buy a house.

Lastly, it is important to stay on track with your budget and financial commitments. Many families handle budgeting and financial management in various ways. But the general idea behind it is to have either a monthly or weekly picture of your expenses and savings. To make it through the numerous financial decisions in your married life, you and your partner have to agree on a budget. You should also engage in financial planning with the whole family, and keep an open dialogue when dealing with family money.